고정 헤더 영역

상세 컨텐츠

본문

| Category | Description |

| Ticker | BABA |

| Company | Alibaba Group Holding Limited |

| Sector | Consumer Cyclical |

| Industry | Internet Retail |

| Country | China |

| Market Cap | 558.02B |

| Volume | 11,070,012 |

| Dividend% | N/A |

| Website | www.alibabagroup.com |

Company Introduction

Alibaba was founded on June 28, 1999 by Chung Tsai and Yun Ma, and is headquartered in Hangzhou, China.

Alibaba primarily provides online and mobile e-commerce services to retailers and wholesalers, Its business consists of core commerce (85%), cloud computing (7%), digital media and entertainment (7%), and innovation initiatives and others (1%).

Core Commerce Segment: Consists of platforms for retail and wholesale. It operates famous shopping malls such as Taobao and Tmall to generate revenue from advertisements and commissions, and is the largest online and mobile commerce company in the world and China. Others include Alibaba Health, an internet platform for pharmaceutical and medical products, Alimama, a revenue generating platform, 1688.com and Alibaba.com for online wholesale, Ali Express for retail, Lazada, an e-commerce platform, and an import e-commerce platform Tmall Global, Lingshoutong, a digital sourcing platform, Cainiao Network, a logistics service platform, Ele.me, a delivery and local service platform, Koubei, a restaurant and local service guide platform, and Fliggy, an online travel platform.

Cloud computing Segment: Alibaba Cloud, which provides elastic computing, databases, storage and content delivery networks, large-scale computing, security, management and applications, big data analytics, machine learning platforms, Internet of Things and other services to various industries.

Digital Media & Entertainment Segment: Produces movies, television series, variety shows, animations and other video content, and runs Youku, an online video platform. Youku offers online videos, movies, live events, news feeds, literature, music and more.

Innovation initiatives and other Segment: including businesses such as mobile digital maps, navigation, real-time traffic information app Amap, business efficiency app DingTalk, AI-powered smart speaker Tmall Genie, and more.

Investment Point

1) Stable e-commerce service: Alibaba ranks first in the Chinese e-commerce market and generates stable revenue through advertising and commissions.

In addition, the Chinese e-commerce market is growing at a high annual growth rate of 18%, which will have a positive impact on Alibaba's sales. By 2022, 70% of Chinese population will shop online, which has great market potential.

2) Cloud service: Alibaba's cloud service is ranked 3rd in the world and 1st in Asia in 2020. In addition, Alibaba Cloud became the No. 1 player in the education cloud sector with a global market share of 24.3%.

Alibaba Cloud is the No. 1 company accounting for more than 40% of the Chinese market share, and its sales are expected to increase rapidly in line with the growth of the Chinese cloud market, which is growing at an average annual rate of 30%.

3) Business diversification: In addition to e-commerce and cloud computing, Alibaba is diversifying businesses such as entertainment, fintech, logistics, and healthcare. The future growth engine will continue as Alibaba is advancing into the offline market linked to the online market.

Past Revenue Trend

Alibaba is showing stable growth through online and mobile e-commerce, and has grown highly by an average of 45% over the past five years.

l Trailing 12 Months: Sum of the previous 12 months

l Quarterly: quarterly results

l YoY Quarterly Growth: Year-on-year growth rate

Past EPS Trend

EPS shows a similar pattern to sales and has grown at an average annual rate of 15% over the past five years.

l EPS: Earning Per Share

Future Sales and EPS trends

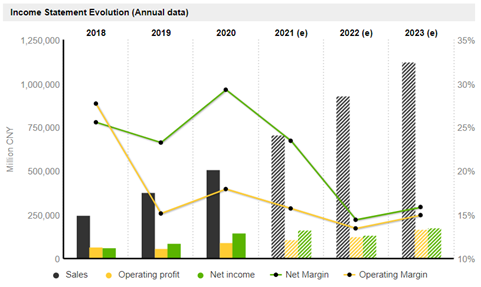

It has maintained high growth at 2020 without being affected by difficult circumstances. And sales are expected to grow at a CAGR of 30% over the next three years, profit at 6%, and EPS at 1.4%. In particular, profit and EPS will have explosive growth

Stock price trend and target price

The average target price of Wall Street analysts is 290.82$ (highest price 350$, lowest price 192$), showing 37.11% upside potential. Moreover, 22 of 24 analysts give a strong buy opinion. (As of July 18, 21)

For hedge funds, the number of shares held increased by 7.8M from the previous quarter.

The investment decision is yours,

but I hope it will be useful information for your investment…

'US stock introduction' 카테고리의 다른 글

| 009_알리바바|Alibaba|阿里巴巴_F (통합본|Consolidation|综合本) (0) | 2021.07.25 |

|---|---|

| 009_알리바바|Alibaba|阿里巴巴_3 (중국어|Chinese|汉语) (0) | 2021.07.23 |

| 009_알리바바|Alibaba|阿里巴巴_1 (한국어|Korean|韩语) (0) | 2021.07.19 |

| 008_넷플릭스|Netflix|网飞_F (통합본|Consolidation|综合本) (0) | 2021.07.18 |

| 008_넷플릭스|Netflix|网飞_3 (중국어|Chinese|汉语) (0) | 2021.07.16 |

댓글 영역