고정 헤더 영역

상세 컨텐츠

본문

| Category | Description |

| Ticker | NVDA |

| Company | NVIDIA Corporation |

| Sector | Technology |

| Industry | Semiconductors |

| Country | USA |

| Market Cap | 503.64B |

| Volume | 9,190,846 |

| Dividend% | 0.10% |

| Website | www.nvidia.com |

Company Introduction

NVIDIA was founded in January 1993 by Jen Hsun Huang, Chris A. Malachowsky, and Curtis R. Priem and is headquartered in Santa Clara, California.

NVIDIA's primary business area is the design and manufacture of computer graphics processors, chipsets and related multimedia software, used in the gaming, data center and automotive markets, and is divided into two business segments: Graphics Processing Units (GPUs), Computing and Networks.

GPU Segment: GeForce GPUs for games and PCs, GeForce NOW game streaming services and related infrastructure, as well as providing solutions for gaming platforms, Quadro for designers, Tesla and DGX for AI data scientists and big data researchers, GRID for cloud-based visual computing users etc.

Computing and Networks Segment: Consolidating entire computers on a single chip, integrating GPUs and multi-core CPUs to power robotics, drones, automotive autonomous driving, as well as supercomputing for consoles, mobile gaming and entertainment devices, and providing platforms and systems for data centers.

NVIDIA owns various customers such as equipment manufacturers, system builders, add-in board manufacturers, retailers/distributors, internet and cloud service providers, automakers and Tier-1 automotive suppliers, mapping companies, startups etc.

Investment Point

NVIDA generates revenue primarily from data center and gaming, accounting for 43% and 45% of total revenue respectively as of Q2 2021, and the data center revenue exceeds gaming revenue for the first time.

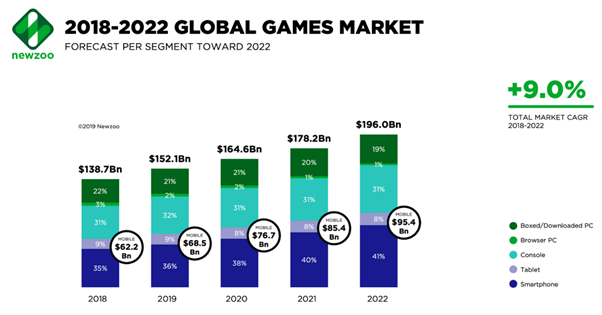

1) Gaming GPU: NVIDA’s flagship GeForce series, GPU is advantageous for processing simple calculations in batches and simultaneously adjusting the color and brightness of numerous pixels in the game. As the game market continues to grow at an average of 9% annually, NVIDA’s GPU sales in the PC and console areas are also showing stable growth.

In particular, revenue for the Q2 of 2021 was $1.65 billion, up 24% QoQ and 26% YoY. It was contributed by expansion of GeForce NOW to Chromebooks, which enabled millions of users to play in the cloud.

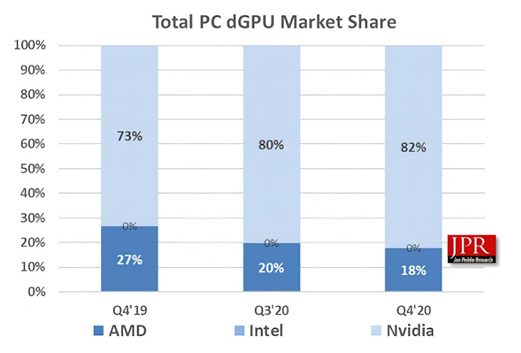

NVIDIA's market share in the dGPU market used for games is unrivaled, with an 80% market share compared to other competitors.

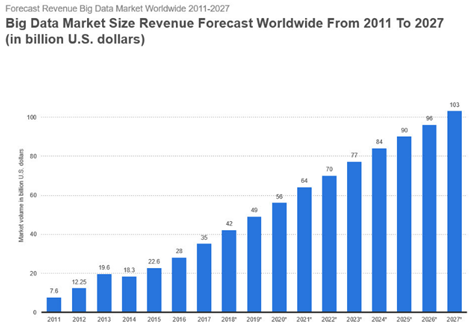

2) Data Center: NVIDIA developed its own platform and solution to design and operate GPUs for data centers, and acquired Mellanox, which makes core network technology between servers and storage in data centers. Based on this technology, NVIDIA is winning a supply contract by launching NVIDIA A100 Tensor Core GPU, which has 7 times the performance of existing products. In particular, revenue for the second quarter of 2021 was $1.75 billion, up 54% QoQ and 167% YoY.

The core of the 4th industrial revolution is data, and cloud services are at the center of it. As a result, data center expansion is required and it is expected to double the current size by 2030, so NVIDIA data center business area is also expected to benefit.

3) Future growth industry: NVIDIA’s automation business is still small, but with Mercedes-Benz, from 2024, a new software-defined vehicle architecture based on NVIDIA DRIVE AV autonomous driving software and NVIDIA AGX Orin AV computer will be introduced to all vehicles in the lineup from 2024. We can expect a leap forward in the promising electric vehicle market.

In addition, NVIDIA is also focusing on research and development in various fields related to the 4th industrial revolution such as robotics, artificial intelligence, and drones etc.

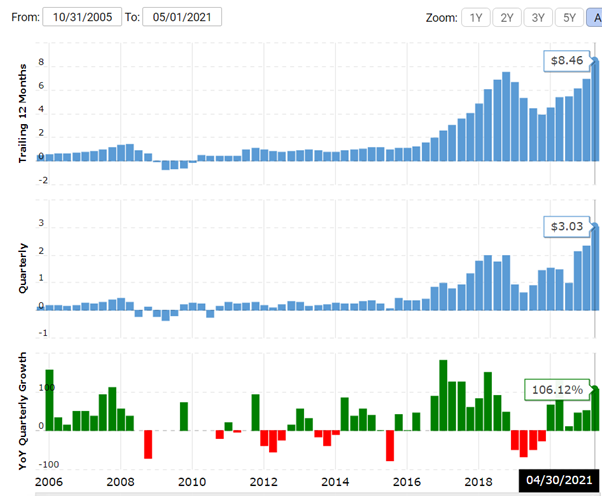

Past Revenue Trend

NVIDIA is showing stable growth through gaming and data center, and has grown highly by an average of 30% over the past five years.

l Trailing 12 Months: Sum of the previous 12 months

l Quarterly: quarterly results

l YoY Quarterly Growth: Year-on-year growth rate

Past EPS Trend

EPS shows a similar pattern to sales and has grown at an average annual rate of 10% over the past five years.

l EPS: Earning Per Share

Future Sales and EPS trends

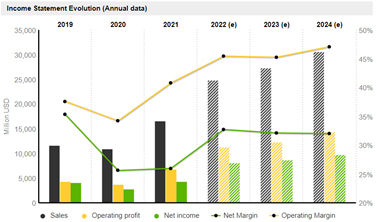

It has maintained high growth at 2020 without being affected by difficult circumstances. And sales are expected to grow at a CAGR of 22% over the next three years, profit at 31%, and EPS at 35%. In particular, profit and EPS will have explosive growth.

Stock price trend and target price

The average target price of Wall Street analysts is 762.96$ (highest price 1000$, lowest price 600$), showing 6.90% downside potential. Moreover, 28 of 29 analysts give a strong buy opinion. (As of July 6, 21)

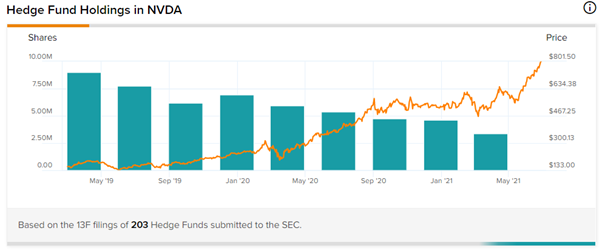

For hedge funds, the number of shares held decreased by 1.2M from the previous quarter.

The investment decision is yours,

but I hope it will be useful information for your investment…

'US stock introduction' 카테고리의 다른 글

| 007_엔비디아|NVIDIA|英伟达_F (통합본|Consolidation|综合本) (0) | 2021.07.11 |

|---|---|

| 007_엔비디아|NVIDIA|英伟达_3 (중국어|Chinese|汉语) (0) | 2021.07.09 |

| 007_엔비디아|NVIDIA|英伟达_1 (한국어|Korean|韩语) (0) | 2021.07.06 |

| 006_테슬라|Tesla|特斯拉_F (통합본|Consolidation|综合本) (0) | 2021.07.04 |

| 006_테슬라|Tesla|特斯拉_3 (중국어|Chinese|汉语) (0) | 2021.07.02 |

댓글 영역