고정 헤더 영역

상세 컨텐츠

본문

| Category | Description |

| Ticker | FB |

| Company | Facebook, Inc. |

| Sector | Communication Services |

| Industry | Internet Content & Information |

| Country | USA |

| Market Cap | 945B |

| Volume | 11,647,002 |

| Dividend% | N/A |

| Website | investor.fb.com |

Company Introduction

Facebook was founded on February 4, 2004 by Mark Elliot Zuckerberg, Dustin Moskovitz, Chris R. Hughes, Andrew McCollum and Eduardo P. Saverin and is headquartered in Menlo Park, California.

Facebook, Inc. is a global social networking company that offers social media products including Facebook, Instagram, Messenger, WhatsApp and Oculus that allow you to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets and home devices.

Facebook: People connect, share, search and communicate with each other on mobile devices and personal computers.

Instagram: A community to share photos, videos and private messages

Messenger and WhatsApp: Messaging applications that allow people to connect with friends, family, groups and businesses across platforms and devices.

Oculus: Augmented and virtual reality products that help people feel connected anytime, anywhere

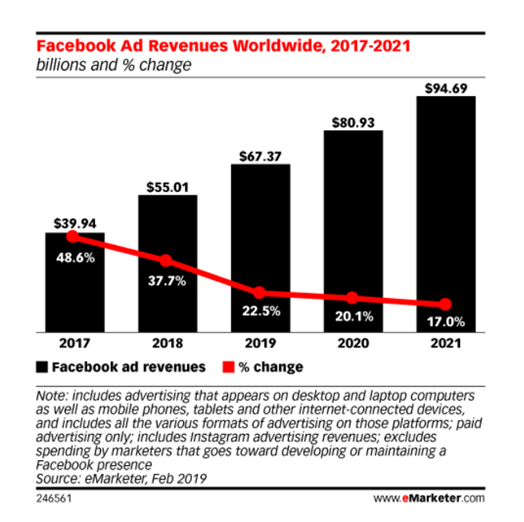

Facebook's net sales are advertising (98.5%) and other (1.5%), whose major revenue is earned by advertising. Revenue is generated in the following geographically such as the US and Canada (45.6%), Europe (23.8%) and Asia/Pacific (21.8%).

Investment Point

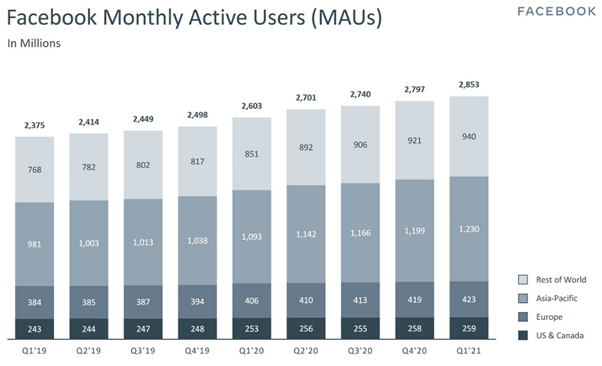

1) Stable advertising revenue: As of December 2020, Facebook is the world's No. 1 SNS company with 2.6 billion daily users and 3.3 billion monthly users. That means 43% of the world's 7.9 billion people use Facebook every month. There are about 200 million business accounts and 10 million advertisers. Facebook's monthly user trend is steadily increasing, and advertising revenue is also increasing proportionally and stably.

2) Virtual Reality (VR) and Augmented Reality (AR): Virtual reality is a technology that creates a virtual environment rather than reality through graphics and makes it feel like reality.

Augmented reality is a technology that superimposes virtual objects or graphics on the present world.

Facebook started selling the virtual reality VR headset Oculus Quest 2 in 2020, and it also showed an explosive response. With the virtual reality headset, you can not only play games, train at home, etc., but also have a cup of coffee with an online friend from the other side of the globe.

In addition, as of 2020, compared to the previous year, Facebook revealed that search volume for augmented reality (AR) and virtual reality (VR) content on the platform increased by 44% compared to the previous year, and the number of related group members increased by 74%, respectively, showing it as a future growth engine.

3) Facebook Shop: In May 2020, Facebook CEO Mark Zuckerberg launched the Facebook Shop through live streaming, which allows small businesses to easily create an online store within the platform for free.

The Facebook Shop allows sellers to register products on their Facebook page, Instagram profile, or Stories. Buyers can send messages to sellers within Facebook, pay for products, and check delivery and more. In addition, the ability to tag products on Facebook and Instagram live streaming is supported, and clicking a tag will take you to the product order page, and so on. It is a service that makes it possible to create a list of products within the Facebook ecosystem without complicated settings or preparations, and to promote, sell, deliver, and after-sales service. With 3 billion users, Facebook is envisioning a model that will earn additional advertising and commission revenue as it enters the commerce business.

Past Revenue Trend

Facebook is showing stable growth through SNS advertisement, and has grown by an average of 37% over the past five years.

l Trailing 12 Months: Sum of the previous 12 months

l Quarterly: quarterly results

l YoY Quarterly Growth: Year-on-year growth rate

Past EPS Trend

Concentrating on sales growth, EPS was sluggish until 2013, but has grown by an average of 47% over the past five years.

l EPS: Earning Per Share

Future Sales and EPS trends

It has maintained high growth at 2020 without being affected by difficult circumstances. And sales are expected to grow at a CAGR of 23% over the next three years, profit at 21%, and EPS at 21%. Although Facebook does not pay dividends, it is used to maintain high growth with reinvesting the surplus.

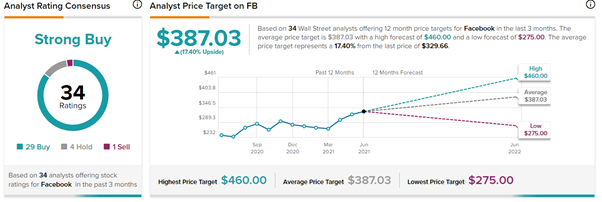

Stock price trend and target price

The average target price of Wall Street analysts is 387.03$ (highest price 460$, lowest price 275$), showing 17.4% upside potential. Moreover, 29 of 32 analysts give a strong buy opinion. (As of June 20, 21)

For hedge funds, the number of shares held increased by 5M from the previous quarter.

The investment decision is yours,

but I hope it will be useful information for your investment…

'US stock introduction' 카테고리의 다른 글

| 005_페이스북|Facebook|脸书_F (통합본|Consolidation|综合本) (0) | 2021.06.26 |

|---|---|

| 005_페이스북|Facebook|脸书_3 (중국어|Chinese|汉语) (0) | 2021.06.25 |

| 005_페이스북|Facebook|脸书_1 (한국어|Korean|韩语) (0) | 2021.06.23 |

| 004_아마존|Amazon|亚马逊_F (통합본|Consolidation|综合本) (0) | 2021.06.22 |

| 004_아마존|Amazon|亚马逊_3 (중국어|Chinese|汉语) (0) | 2021.06.21 |

댓글 영역