고정 헤더 영역

상세 컨텐츠

본문

| Category | Description |

| Ticker | BIDU |

| Company | Baidu, Inc. |

| Sector | Communication Services |

| Industry | Internet Content & Information |

| Country | China |

| Market Cap | 63.07B |

| Volume | 7,595,511 |

| Dividend% | N/A |

| Website | www.baidu.com |

Company Introduction

Baidu was founded on January 18, 2000 by Yanhong Li and Xu Yong, and is headquartered in Beijing, China.

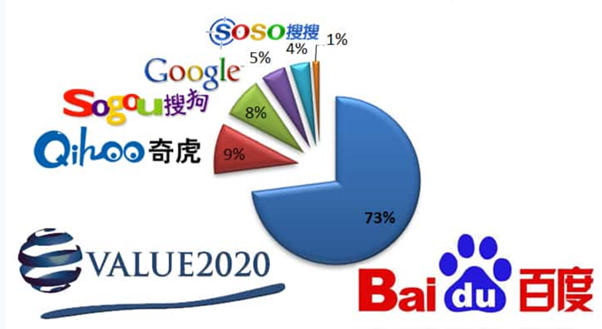

Baidu is China's No. 1 internet search engine and provides online marketing solutions and operates in two business segment: Baidu Core (60%), which operates a search engine, and iQIYI (30%), which provides Internet video streaming service. Baidu is also monetizing from cloud service and other sectors.

Baidu Core Segment: Baidu App to primarily use mobile devices to access search, feeds and other services; Baidu Search to access search and other services; to provide personalized timelines based on users' demographics and interests Baidu Feed, a short video app Haokan, a Quanmin flash video app that allows users to create and share short videos, Baidu Knows, an online community where users can ask questions to other users, Baidu Post, a social media platform, and Baidu Maps, a voice-enabled mobile app that provides travel-related services. Baidu is monetizing from advertising and service fees with these services.

In addition, Baidu provides various cloud services and solutions such as platform (PaaS), software (SaaS), and infrastructure (IaaS).

In addition, it provides autonomous driving services, electric vehicles, and robo-taxi, and has a strategic partnership with Zhejiang Geely Holding Group.

iQIYI Segment: Provides online entertainment services including original and licensed content, video content membership and online advertising services.

Investment Point

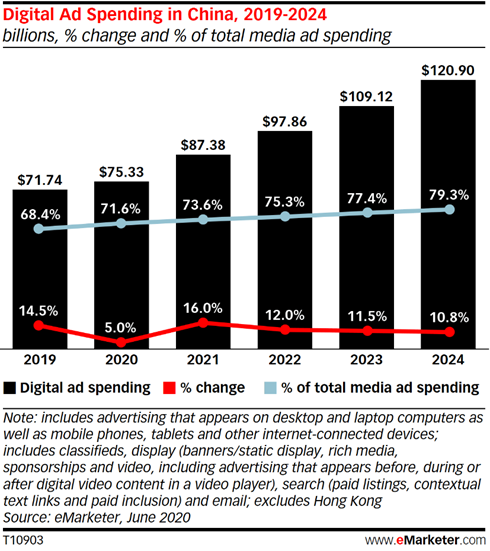

1) Stable online advertising revenue: Baidu's main source of income is advertising revenue generated by Baidu Core, and the Chinese online advertising market is expected to grow 10% annually in the future, resulting in stable revenue growth.

2) Cloud service: Baidu is the 4th largest cloud provider in China and will be beneficial from Chinese government's will to grow the cloud market by combining new technologies such as AI. With the growth of the Chinese cloud market, which is growing at a CAGR of 30%, sales are expected to increase rapidly.

3) Business diversification (autonomous driving, robo-taxi, electric vehicle): Autonomous driving - Baidu has been researching autonomous driving technology since 2013 and is also a leading Chinese autonomous driving technology company. Baidu's Apollo has 4.3 million test miles and 199 autonomous driving licenses in China as of the end of 2020, which is more than the 20 licenses owned by the second-largest company. As shown in the table below, China has a huge market accounting for 44% of the global 33 million autonomous vehicles by 2040, so it will be a good investment to Baidu in the long term.

Robo-Taxi - Baidu is piloting a robot-taxi service called Apollo Go using autonomous driving technology and is currently the only company in the world to obtain a license in Beijing. The prospects are bright as it plans to sequentially expand in 30 large cities over the next three years.

Electric Vehicles - In early 2021, Baidu had formed partnership with Geely Motors to establish an intelligent car company and to produce intelligent electric vehicles that combine Baidu's autonomous driving technology and Geely's electric vehicle manufacturing technology to benefit from the growth trend of electric vehicles.

Past Revenue Trend

Baidu is showing stable growth through online advertising revenue and has grown at an average of 11% over the past five years.

l Trailing 12 Months: Sum of the previous 12 months

l Quarterly: quarterly results

l YoY Quarterly Growth: Year-on-year growth rate

Past EPS Trend

EPS deteriorated in difficult circumstances last year then recovered and has grown at an average annual rate of 34% over the past five years.

l EPS: Earning Per Share

Future Sales and EPS trends

It has maintained high growth at 2020 without being affected by difficult circumstances. And sales are expected to grow at a CAGR of 16% over the next three years, profit at 5%, and EPS at 4%.

Stock price trend and target price

The average target price of Wall Street analysts is 290.86$ (highest price 372$, lowest price 156$), showing 87.31% upside potential. Moreover, 13 of 17 analysts give a buy opinion. (As of July 28, 21)

For hedge funds, the number of shares held decreased by 1.0M from the previous quarter.

The investment decision is yours,

but I hope it will be useful information for your investment…

'US stock introduction' 카테고리의 다른 글

| 010_바이두|Baidu|百度_F (통합본|Consolidation|综合本) (0) | 2021.08.01 |

|---|---|

| 010_바이두|Baidu|百度_3 (중국어|Chinese|汉语) (0) | 2021.07.31 |

| 010_바이두|Baidu|百度_1 (한국어|Korean|韩语) (0) | 2021.07.28 |

| 009_알리바바|Alibaba|阿里巴巴_F (통합본|Consolidation|综合本) (0) | 2021.07.25 |

| 009_알리바바|Alibaba|阿里巴巴_3 (중국어|Chinese|汉语) (0) | 2021.07.23 |

댓글 영역