고정 헤더 영역

상세 컨텐츠

본문

| Category | Description |

| Ticker | AMZN |

| Company | Amazon.com, Inc. |

| Sector | Consumer Cyclical |

| Industry | Internet Retail |

| Country | USA |

| Market Cap | 1635B |

| Volume | 2,009,330 |

| Dividend% | N/A |

| Website | www.amazon.com |

Company Introduction

Amazon was founded in July 1994 by Jeffrey P. Bezos as a groundbreaking online book seller in his garage, and is now headquartered in Seattle, Washington.

Amazon is the world's largest online shopping provider with a very broad range of online retail shopping services in North America (61%), international (26%) and Amazon Web Services (AWS) (13%) based on e-commerce platforms. In addition, subscription service through Amazon Prime is also provided.

Online retail shopping service: provide not only general products and books, but also second-hand transactions through web services, groceries such as Whole Foods Market, Amazon Alexa which is a cloud-based artificial intelligence platform. Moreover Amazon produces and sells electronic products such as Amazon Fire (tablets, TVs), Amazon Echo (smart speaker), Kindle e-book and various electronic products to provide services to consumers, sellers, developers, companies and content creators as well.

Cloud Services (AWS): Global sales of computing, storage, database and AWS service products for startups, enterprises, government agencies, and educational institutions.

Subscription Service: Amazon Prime, a membership program with free shipping, which can also be used to access streaming movies and TV episodes and other services.

Investment Point

1) Leader in e-commerce: Both buyers and sellers have high trust in Amazon, increase sales and speedy delivery using the FBA (Fulfillment by Amazon) system, and have the advantage of easy inventory management, price adjustment and returns. In addition, in order to reduce logistics costs as the number of Amazon members increases, Amazon is investing in logistics, such as buying ships and trucks, acquiring courier companies, and even purchasing planes.

Recently, after focusing only on the North American market, it is also entering the international market, and in the first quarter of 2021, sales in the international market increased by 60% compared to the same period last year.

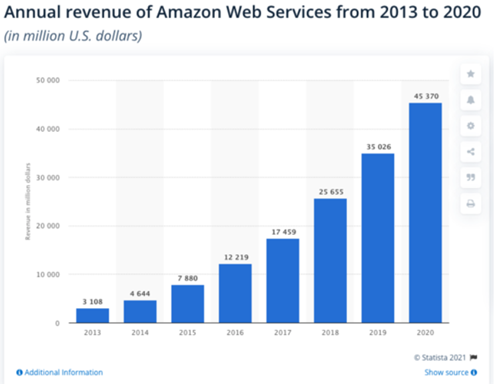

2) Cloud: Cloud service Amazon AWS is the world's No.1. MS is 33% of the total market, its sales over the past five years show an average annual growth of 40% and are expected to maintain high growth. In addition, the operating margin will average 25%, driving Amazon's high-margin growth.

AWS provides solutions in a variety of fields including Advertising & Marketing, Financial Services, Game Tech, Healthcare & Life Sciences, Manufacturing, Media & Entertainment, Telecommunications, Travel & Hospitality, and more.

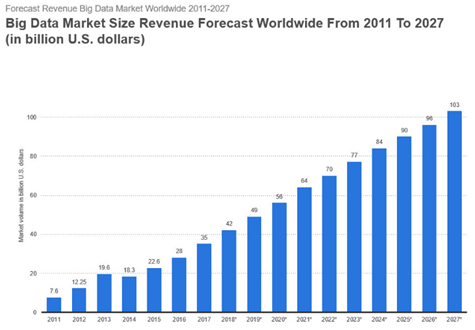

The core of the 4th industrial revolution is data, and cloud services are at the center of it. As a result, it is necessary to expand the data center, and it is predicted that the number of data centers will double by 2030.

3) Subscription Service: Amazon Prime has over 200 million memberships in Q1 2021, is growing at a CAGR of 60%, and reached $9.9 billion in revenue in 2020.

Past Revenue Trend

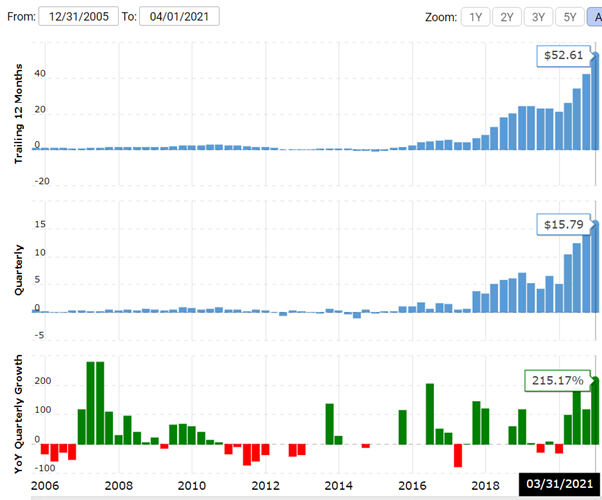

Amazon is showing stable growth through web services, cloud services and subscription services, and has grown by an average of 30% over the past five years.

l Trailing 12 Months: Sum of the previous 12 months

l Quarterly: quarterly results

l YoY Quarterly Growth: Year-on-year growth rate

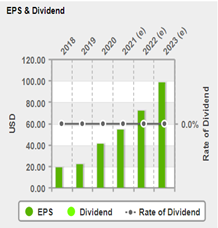

Past EPS Trend

Concentrating on sales growth, EPS was sluggish until 2014, but has grown by an average of 84% over the past five years.

l EPS: Earning Per Share

Future Sales and EPS trends

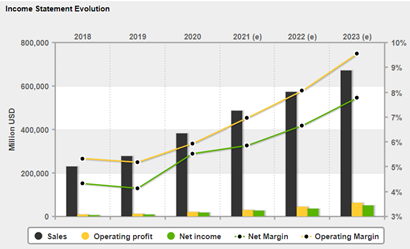

It has maintained high growth at 2020 without being affected by difficult circumstances. And sales are expected to grow at a CAGR of 20% over the next three years, profit at 35%, and EPS at 33%. Although Google does not pay dividends, it is used to maintain high growth with reinvesting the surplus.

Stock price trend and target price

The average target price of Wall Street analysts is 4297.58$ (highest price 5500$, lowest price 3720$), showing 23.25% upside potential. Moreover, all 32 analysts give a strong buy opinion. (As of June 19, 21)

For hedge funds, the number of shares held increased by 661k from the previous quarter.

The investment decision is yours,

but I hope it will be useful information for your investment…

'US stock introduction' 카테고리의 다른 글

| 004_아마존|Amazon|亚马逊_F (통합본|Consolidation|综合本) (0) | 2021.06.22 |

|---|---|

| 004_아마존|Amazon|亚马逊_3 (중국어|Chinese|汉语) (0) | 2021.06.21 |

| 004_아마존|Amazon|亚马逊_1 (한국어|Korean|韩语) (0) | 2021.06.19 |

| 003_구글|Google|谷歌_F (통합본|Consolidation|综合本) (2) | 2021.06.18 |

| 003_구글|Google|谷歌_3 (중국어|Chinese|汉语) (2) | 2021.06.15 |

댓글 영역