고정 헤더 영역

상세 컨텐츠

본문

| Category | Description |

| Ticker | GOOG |

| Company | |

| Sector | Communication Services |

| Industry | Internet Content & Information |

| Country | USA |

| Market Cap | 1662B |

| Volume | 857,630 |

| Dividend% | N/A |

| Website | www.abc.xyz |

Company Introduction

Google's parent company is Alphabet, and Google is responsible for 99% of the company's total revenue. Alphabet was founded in 1998 and is headquartered in Mountain View, California.

Alphabet is a wholly-owned subsidiary of Internet media giant - Google, and consists primarily of Google Services, Google Cloud and other segments.

Google Services: Offers products and services such as Advertising, Android, Chrome, Hardware, Google Maps, Google Play, Search and YouTube, as well as technology infrastructure.

Google Cloud: Provides an infrastructure and data analytics platform, collaboration tools, and other services for enterprise customers

Other Segments: Comprised of future commercialized technology development areas such as Access, Calico, CapitalG, GV, Verily, Waymo and X

Google accounts for 99% of the company's revenue, and more than 85% of that comes from online advertising. In addition, revenue is generated from the sale of apps and content through Google Play and YouTube, cloud service fees and other licenses. In addition, considering future growth potential, google is investing in various fields such as healthcare (Verily), fast home internet access (Google Fiber), and self-driving cars (Waymo).

In addition, Alphabet's operating profit margin is 25%-30% which is led by Google’s 30% margin. Most other business is under loss which caused initial investing and research stage.

Google provides online advertising services in the US, Europe, Middle East, Africa, Asia Pacific, Canada and Latin America, with net revenues from the US (46.2%), the Americas (5.6%), Europe/Middle East/Africa (31.3%), Asia/Pacific (16.6%).

Investment Point

1) Online advertising revenue: Alphabet has the No. 1 search engine - Google, No. 1 video sharing platform - YouTube, No. 1 mobile OS - Android, etc., and are generating various non-capital ad revenues with websites and videos. It accounts for 85% of Google's total sales, maintaining stable growth and the CAGR is 20%.

2) Cloud: Cloud service is the third largest after Amazon AWS and Microsoft Azure, and occupies 8% of the total market, the sales in 2020 showed a growth of 47% compared to the previous year and will maintain high growth.

The core of the 4th industrial revolution is data, and cloud services are at the center of it. As a result, it is necessary to expand the data center, and it is predicted that the big data market will be doubled by 2030.

3) Future growth business: continuing research on various subsidiaries focusing on future growth businesses, such as Calico, which aims to increase human life to 500 years, Deepmind, which created Alpha Go, Waymo, which provides self-driving shared car service, and Wings Aviation, which is researching drone delivery service.

Past Revenue Trend

Google is showing stable growth with online advertising revenue and cloud services, and has grown at an average of 20% over the past five years.

l Trailing 12 Months: Sum of the previous 12 months

l Quarterly: quarterly results

l YoY Quarterly Growth: Year-on-year growth rate

Past EPS Trend

EPS also shows similar growth pattern with revenue and has grown at an average of 26% over the past five years.

l EPS: Earning Per Share

Future Sales and EPS trends

In 2021, due to the base effect, the sales grow 29%. And sales are expected to grow at a CAGR of 20% over the next three years, profit at 22%, and EPS at 24%. Although Google does not pay dividends, it is used to maintain high growth with reinvesting the surplus.

Stock price trend and target price

The average target price of Wall Street analysts is 2683.33$ (highest price 2875$, lowest price 2510$), showing 6.74% upside potential. Moreover, all 10 analysts give a strong buy opinion. (As of June 13, 21)

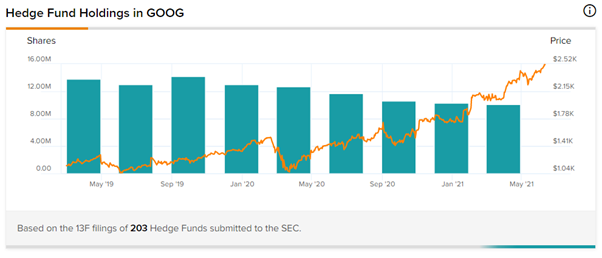

For hedge funds, the number of shares held decreased by 174k from the previous quarter.

The investment decision is yours,

but I hope it will be useful information for your investment…

'US stock introduction' 카테고리의 다른 글

| 003_구글|Google|谷歌_F (통합본|Consolidation|综合本) (2) | 2021.06.18 |

|---|---|

| 003_구글|Google|谷歌_3 (중국어|Chinese|汉语) (2) | 2021.06.15 |

| 003_구글|Google|谷歌_1 (한국어|Korean|韩语) (0) | 2021.06.13 |

| 002_마이크로소프트|Microsoft|微软_F (통합본|Consolidation|综合本) (0) | 2021.06.11 |

| 002_마이크로소프트|Microsoft|微软_3 (중국어|Chinese|汉语) (1) | 2021.06.10 |

댓글 영역