고정 헤더 영역

상세 컨텐츠

본문

| Category | Description |

| Ticker | V |

| Company | Visa Inc. |

| Sector | Financial |

| Industry | Credit Services |

| Country | USA |

| Market Cap | 492.98B |

| Volume | 5,445,425 |

| Dividend% | 0.60%(1.22$) |

| Website | usa.visa.com |

Company Introduction

Visa was founded in 1958 by Dee Hock and is headquartered in San Francisco, California.

Visa is a global provider of electronic payment technology. It operates electronic payment networks primarily between individual consumers, merchants, financial institutions, businesses, strategic partners and government agencies through Visa Net, a transaction processing network that enables the authorization, clearing and settlement of transactions. Visa also provides products and platforms such as debit cards, credit cards, prepaid cards, payment solutions, and global ATMs. Revenue consists of services, data processing, and international transactions, each accounting for one-third.

Investment Point

1) Annual increasing dividend: As a dividend aristocrat stock, VISA has increased its dividend by 25% annually over the past 10 years from $0.13 per share in 2010 to $1.22 per share in 2020. Dividends are paid quarterly, usually in March, June, September and December.

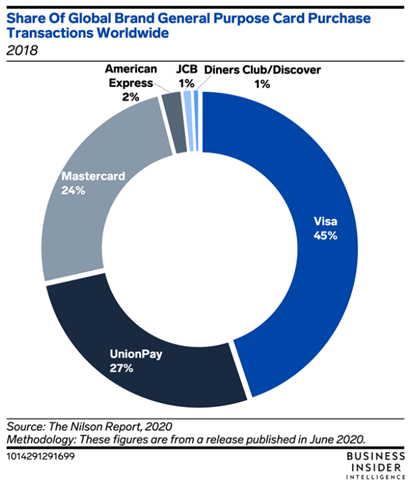

2) Growth potential: Visa is the world's No. 1 company with a global market share of 45%, and is on par with Mastercard, which accounts for 24%. UnionPay is a Chinese company, mainly used in China.

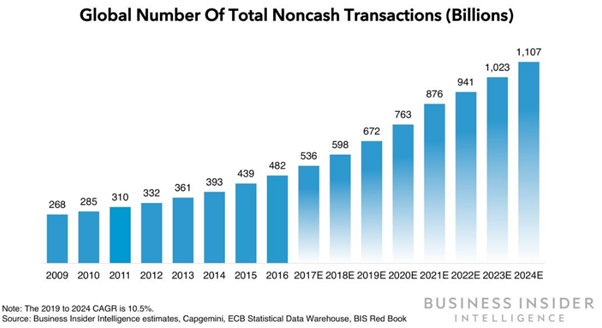

Non-cash transactions such as credit and debit cards around the world have a growth potential of 11% in the future, and growth potential is mainly in North America, Western Europe, and Asia, which lead the global economy.

Past Revenue Trend

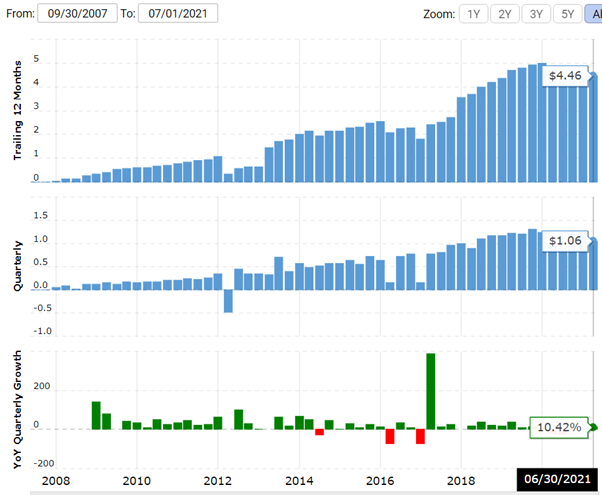

Visa is generating profits through payment network commission; it has been experiencing a growth of 9% on average over the past five years

l Trailing 12 Months: Sum of the previous 12 months

l Quarterly: quarterly results

l YoY Quarterly Growth: Year-on-year growth rate

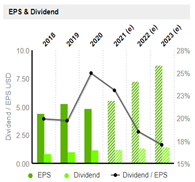

Past EPS Trend

EPS shows a similar pattern to sales and has grown at an average annual rate of 17% over the past five years.

l EPS: Earning Per Share

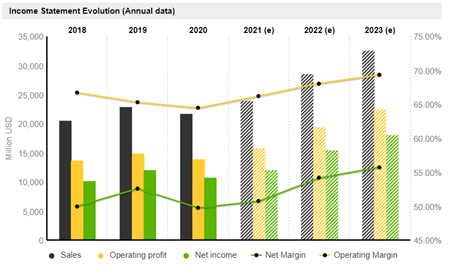

Future Sales and EPS trends

Sales have stagnated in difficult circumstances at 2020. And sales are expected to grow at a CAGR of 14%, profit at 19%, and EPS at 21% over the next three years. In particular, the dividend per share is expected to grow 7% annually.

Stock price trend and target price

The average target price of Wall Street analysts is 281.6$ (highest price 305$, lowest price 250$), showing 21.04% upside potential. Moreover, 20 of 21 analysts gave a buy opinion. (As of August 16, 21)

For hedge funds, the number of shares held decreased by 27.5M from the previous quarter.

The investment decision is yours,

but I hope it will be useful information for your investment…

'US stock introduction' 카테고리의 다른 글

| 013_비자|VISA|维萨_F (통합본|Consolidation|综合本) (0) | 2021.08.22 |

|---|---|

| 013_비자|VISA|维萨_3 (중국어|Chinese|汉语) (0) | 2021.08.20 |

| 013_비자|VISA|维萨_1 (한국어|Korean|韩语) (0) | 2021.08.17 |

| 012_뱅크 오브 아메리카|Bank of America|美国银行_F (통합본|Consolidation|综合本) (0) | 2021.08.15 |

| 012_뱅크 오브 아메리카|Bank of America|美国银行_3 (중국어|Chinese|汉语) (0) | 2021.08.13 |

댓글 영역