고정 헤더 영역

상세 컨텐츠

본문

| Category | Description |

| Ticker | MSFT |

| Company | Microsoft Corporation |

| Sector | Technology |

| Industry | Software - Infrastructure |

| Country | USA |

| Market Cap | 1860B |

| Volume | 19,343,939 |

| Dividend% | 1.00% |

| Website | www.microsoft.com |

Company Introduction

Microsoft was founded in 1975 by Bill Gates and Paul Allen to develop and market interpreters and is headquartered in Redmond, Washington.

l 1982: Microsoft's logo used until 1987 was 'blibbet'

l 1987: Our most familiar logo, 'Pac-Man', was used until Microsoft changed its logo in 2012.

l 2012: Steve Jobs' Apple started a smart revolution, and Microsoft introduced 'Windows Phone' to keep up with the times and changed the logo to the current 2012 logo.

Microsoft is the world's largest software and hardware global company that develops Windows operating systems (OS) and MS Office, cloud services, desktop & server management tools, business solutions, and software development tools, as well as devices such as PCs and tablets, video games (Xbox), and gaming/entertainment contents. After 2014, under the leadership of the current CEO, Satya Nadella, Microsoft is taking a second leap by introducing cloud service Azure and software subscription service (Microsoft 365).

With technology development, various devices, platforms, and services appeared in the market. Users who previously worked only through PCs can use necessary functions without paying or at a low cost. Moreover, many of Microsoft's businesses have low barriers to entry, so developing innovative products and services are critical to staying competitive.

Microsoft’s business regions include North and South America, Europe, India, the Middle East, China, Hong Kong, Taiwan, and Australia, and Apple’s business is highly dependent on overseas sales as it operates in most regions of the world. It is one of the world's three largest network company, and has 2.5 times the number of data centers compared to Amazon's AWS and 7 times the number of data centers compared to Google. Nevertheless, it is providing the first multinational cloud service in mainland China.

Investment Point

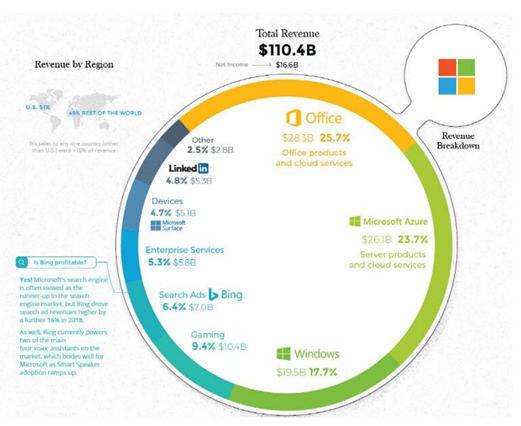

1) Stable growth due to business diversification: Three major business areas, including productivity and business environment, cloud, and personal computing, each account for 1/3 of total sales, achieving balanced growth.

2) High growth margin: Due to the high market share and growth potential of the cloud service Azure which ranks second after Amazon AWS is growing at a high rate of 50 – 100% annually, and subscription services for various software are also contributing to stable cash flow generation.

The core of the 4th industrial revolution is data, and cloud services are at the center of it. As a result, it is necessary to expand the data center, and it is predicted that the big data market will be doubled by 2030.

3) Shareholder-friendly: Apple's current growth has slowed, but it's been steadily increasing its share price by buying back stock based on surplus. The dividend has been raised every year for the 17th year to return to shareholders.

l Buy-back will eliminate stocks in the market which will increase stock price in this way.

Past Revenue Trend

Microsoft is showing stable growth due to the diversification of three major business areas such as productivity and business environment, cloud and personal computing, and it has been growing at an average of 9% over the past five years.

l Trailing 12 Months: Sum of the previous 12 months

l Quarterly: quarterly results

l YoY Quarterly Growth: Year-on-year growth rate

Past EPS Trend

EPS also shows similar growth pattern with revenue and has grown at an average of 43% over the past five years.

l EPS: Earning Per Share

Future Sales and EPS trends

In 2021, due to the base effect, the sales grow 16%. And sales are expected to grow at a CAGR of 13% over the next three years, profit at 17%, and EPS at 18%.

Stock price trend and target price

The average target price of Wall Street analysts is 297.96$ (highest price 340$, lowest price 270$), showing 17.6% upside potential. Moreover, all 26 analysts give a buy opinion. (As of June 9, 21)

For hedge funds, the number of shares held increased by 5M from the previous quarter.

The investment decision is yours,

but I hope it will be useful information for your investment…

'US stock introduction' 카테고리의 다른 글

| 002_마이크로소프트|Microsoft|微软_F (통합본|Consolidation|综合本) (0) | 2021.06.11 |

|---|---|

| 002_마이크로소프트|Microsoft|微软_3 (중국어|Chinese|汉语) (0) | 2021.06.10 |

| 002_마이크로소프트|Microsoft|微软_1 (한국어|Korean|韩语) (2) | 2021.06.08 |

| 001_애플|Apple|苹果_F (통합본|Consolidation|综合本) (2) | 2021.06.07 |

| 001_애플|Apple|苹果_3 (중국어|Chinese|汉语) (0) | 2021.06.07 |

댓글 영역