고정 헤더 영역

상세 컨텐츠

본문

| Category | Description |

| Ticker | AAPL |

| Company | Apple Inc. |

| Sector | Technology |

| Industry | Consumer Electronics |

| Country | USA |

| Market Cap | 2098B |

| Volume | 58,893,800 |

| Dividend% | 0.70% |

| Website | https://www.apple.com/ |

Company Introduction

Apple was founded in 1977 by Steven Paul Jobs, Ronald Gerald Wayne, and Steven G. Wozniak and headquarter is in Cupertino, California.

Apple is a global company that provides smartphones (iPhone), PC (Mac), tablet (iPad), wearables, other accessories, digital content stores, streaming services, Apple Care, iCloud, and Apple Arcade. In addition, Fintech Apple Card and future electric vehicle Apple Car are preparing to diversify products portfolio and expected to enhance synergy with current various services.

Apple’s business regions include North and South America, Europe, India, the Middle East, Africa, China, Hong Kong, Taiwan, and Australia, and Apple’s business is highly dependent on overseas sales as it operates in most regions of the world.

Due to the rapid technology development and the fierce competition in the market where numerous new products are released every day, companies with a variety of product lines such as lower prices and more customers than Apple are the main competitors, and compete who provides free contents are also Apple’s potential competitors.

Investment Point

1) Premium strategy: cost-effective device + good design IT company

2) High-margin service sales: 30% of the App Store is Apple's revenue, and the service margin is about 60% which continues to increase every year, and subscribers such as Apple Music, TV+, and News are increasing steadily.

3) Shareholder-friendly: Apple's current growth has slowed, but it's been steadily increasing its share price by buying back stock based on surplus and raising its dividend every year.

l Buy-back will eliminate stocks in the market which will increase stock price in this way.

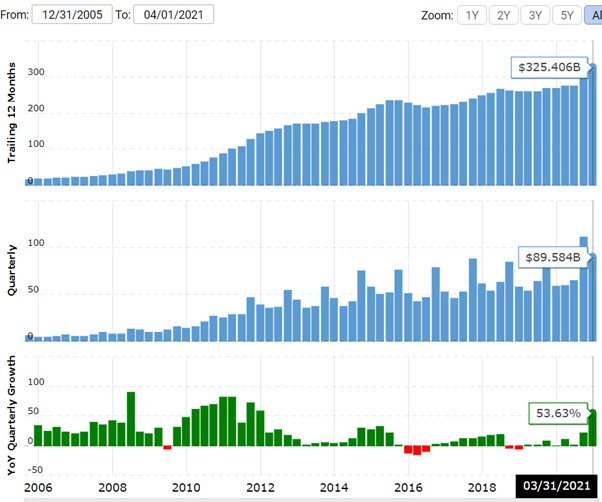

Past Revenue Trend

Apple’ revenue are concentrated in the fourth quarter due to seasonality in sales of shopping events such as Christmas, Black Friday, and Cyber Monday at the end of the year, and it has grown by an average of 7% over the past five years.

l Trailing 12 Months: Sum of the previous 12 months

l Quarterly: quarterly results

l YoY Quarterly Growth: Year-on-year growth rate

Past EPS Trend

EPS also shows similar growth pattern with revenue and has grown at an average of 12% over the past five years.

l EPS: Earning Per Share

Future Sales and EPS trends

In 2021, due to the base effect, the sales grow 30%. And sales are expected to grow at a CAGR of 12% over the next three years, profit at 17%, and EPS at 21%.

Stock price trend and target price

The average target price of Wall Street analysts is 157.58$ (highest price 185$, lowest price 90$), showing 25.2% upside potential. Moreover, 19 out of 26 analysts give a buy opinion. (As of June 7, 21)

For hedge funds, the number of shares held decreased by 376k from the previous quarter.

The investment decision is yours,

but I hope it will be useful information for your investment…

'US stock introduction' 카테고리의 다른 글

| 001_애플|Apple|苹果_F (통합본|Consolidation|综合本) (2) | 2021.06.07 |

|---|---|

| 001_애플|Apple|苹果_3 (중국어|Chinese|汉语) (0) | 2021.06.07 |

| 001_애플|Apple|苹果_1 (한국어|Korean|韩语) (4) | 2021.06.03 |

| 부자 아빠 되는 여정 Intro (2) | 2021.06.03 |

| 미국 상장 기업과 함께 떠나는 첫여정 - 미국 기업을 투자할수 밖에 없는 이유? (0) | 2021.05.23 |

댓글 영역